The Complete Guide to Sending an Online Tax Return in Australia in 2024

The Complete Guide to Sending an Online Tax Return in Australia in 2024

Blog Article

Worry-free Tax Obligation Period: The Benefits of Filing Your Online Income Tax Return in Australia

The tax season can frequently feel overwhelming, however submitting your tax return online in Australia offers a streamlined approach that can ease a lot of that stress. With user-friendly systems given by the Australian Tax Office, taxpayers benefit from attributes such as pre-filled information, which not just simplifies the process yet likewise boosts precision.

Streamlined Filing Refine

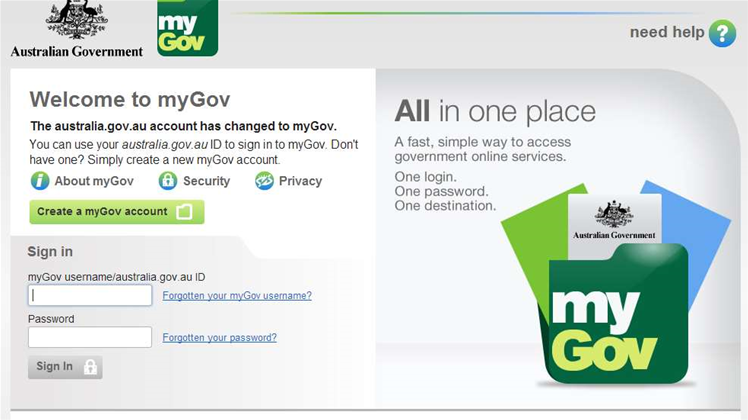

Lots of taxpayers frequently locate the on-line income tax return process in Australia to be uncomplicated and reliable. The Australian Taxation Workplace (ATO) has actually created an easy to use online system that simplifies the filing process. Taxpayers can access their accounts via the ATO internet site or mobile app, where they are guided step-by-step via the submission procedure.

Furthermore, the on-line system is readily available 24/7, using adaptability for taxpayers to submit at their convenience. Using secure innovation makes certain that individual details remains protected throughout the procedure. By getting rid of a number of the intricacies related to standard paper forms, the online income tax return procedure not only enhances clarity yet additionally encourages taxpayers to take control of their economic reporting with confidence. This streamlined declaring process is a substantial advancement, making tax season much less daunting for Australians.

Time-Saving Benefits

The on-line tax obligation return procedure in Australia not just simplifies declaring yet additionally supplies significant time-saving benefits for taxpayers. Among one of the most significant benefits is the capability to finish the entire procedure from the convenience of one's home, removing the requirement for in-person consultations with tax obligation experts. This ease permits people to select a time that suits their schedules, leading to raised effectiveness.

Furthermore, on-line systems normally offer user-friendly user interfaces and detailed guidance, which aid taxpayers navigate the intricacies of tax filing without substantial prior understanding. The pre-filled details supplied by the Australian Taxes Office (ATO) further simplifies the procedure, enabling individuals to swiftly confirm and update their details instead than beginning from scrape.

An additional benefit is the immediate accessibility to resources and support via online assistance sections and discussion forums, enabling taxpayers to fix queries right away. The capacity to conserve progress and return to the return at any moment likewise adds to time performance, as customers can handle their workload according to their personal commitments. On the whole, the on-line tax return system substantially decreases the time and initiative required to satisfy tax obligation responsibilities, making it an appealing alternative for Australian taxpayers.

Boosted Accuracy

Enhanced accuracy is a substantial advantage of filing income tax return online in Australia (online tax return in Australia). The electronic systems made use of for online tax submissions are designed with built-in checks and validations that minimize the risk of human mistake. Unlike traditional paper techniques, where hand-operated calculations can bring about errors, on the internet systems automatically perform calculations, making sure that figures are proper prior to submission

Additionally, lots of online tax solutions provide features such as information import choices from prior tax returns and pre-filled details from the Australian Taxation Workplace (ATO) This combination not only simplifies the process however likewise improves accuracy by minimizing the need for hands-on information entrance. Taxpayers can cross-check their info more effectively, dramatically reducing the chances of errors that can lead to tax obligation responsibilities or postponed reimbursements.

Furthermore, on the internet tax declaring systems commonly give immediate responses relating to possible discrepancies or noninclusions. This positive strategy allows taxpayers to remedy issues in actual time, guaranteeing compliance with Australian tax regulations. In summary, by choosing to find out this here file online, people can profit from an extra precise income tax return experience, inevitably adding to a smoother and more reliable tax obligation period.

Quicker Reimbursements

Submitting income tax return online not just enhances precision but likewise speeds up the reimbursement procedure for Australian taxpayers. Among the considerable advantages of electronic declaring is the speed at which refunds are refined. When taxpayers submit their returns online, the details is transmitted directly to the Australian Taxes Office (ATO), decreasing delays associated with documents handling and manual handling.

Commonly, online income tax return are refined quicker than paper returns. online tax return in Australia. While paper submissions can take numerous weeks to be assessed and settled, digital filings commonly result in reimbursements being released within an issue of days. This performance is specifically valuable for people who rely upon their tax obligation refunds for important costs or monetary preparation

Eco-Friendly Option

Selecting on the internet income tax return presents an environmentally friendly alternative to traditional paper-based declaring approaches. The shift to electronic processes considerably lowers the reliance on paper, which consequently decreases deforestation and lowers the carbon impact related to printing, shipping, and saving paper files. In Australia, where environmental issues are progressively extremely important, embracing online tax declaring straightens with broader sustainability goals.

Moreover, digital entries decrease waste produced from printed envelopes and kinds, contributing to a cleaner setting. Not only do taxpayers take advantage of a more effective declaring process, however they also play an energetic function in promoting eco-conscious practices. The digital approach permits prompt accessibility to tax papers and records, eliminating the need for physical storage solutions that can eat extra sources.

Final Thought

Finally, filing tax obligation returns online in Australia presents various benefits, this consisting of a streamlined procedure, significant time financial savings, boosted precision through pre-filled information, expedited refunds, and an environmentally friendly method. These attributes collectively boost the general experience for taxpayers, fostering an extra sustainable and effective approach of taking care of tax obligations. As electronic services remain to progress, the benefits of on the internet declaring are most likely to end up being progressively pronounced, additional motivating taxpayers to accept this modern method.

The tax obligation season can typically really feel frustrating, however submitting your tax return online in Australia uses a structured method that can ease much of that stress. Generally, the on the internet tax obligation return system considerably reduces the time and initiative needed to satisfy tax commitments, making it an appealing choice for Australian taxpayers.

Furthermore, numerous on-line tax obligation services supply functions such as information import choices from prior tax returns and pre-filled info from the Australian Taxes Workplace (ATO) In recap, by choosing to submit online, people can profit from a much more accurate tax obligation return experience, inevitably adding to a smoother and much more efficient tax obligation season.

Commonly, on the internet tax returns are processed much more quickly than paper returns.

Report this page